Dunning

A document to be sent as a persistent demand for debt payment.

Dunning is a document to store and send as a persistent demand for debt payment against an unpaid Sales Invoice.

To access the Dunning list, go to:

Home > Accounting > Dunning

1. Prerequisites

-

A Dunning can only be created against an overdue Sales Invoice.

Dunning Type

A Dunning Type is used to pre-fill interest, fees and text blocks in a new Dunning.

2. How to create a Dunning

A Dunning is created against a list of overdue scheduled payments. You can create a dunning in two different ways:

a) Create a new Dunning

- Go to the Dunning list and click on "Add Dunning".

- Select a Customer and click "Fetch Overdue Payments". This will show a list of overdue Sales Invoices for this customer. Select the ones you would like to fetch into this Dunning and click on "Get Items".

b) Create a Dunning from an overdue Sales Invoice

- Go to the Sales Invoice list and open any overdue Sales Invoice.

- Click on "Create > Dunning". This will fetch all overdue payments from the invoice's payment schedule table into a new Dunning.

Fill the remaining fields

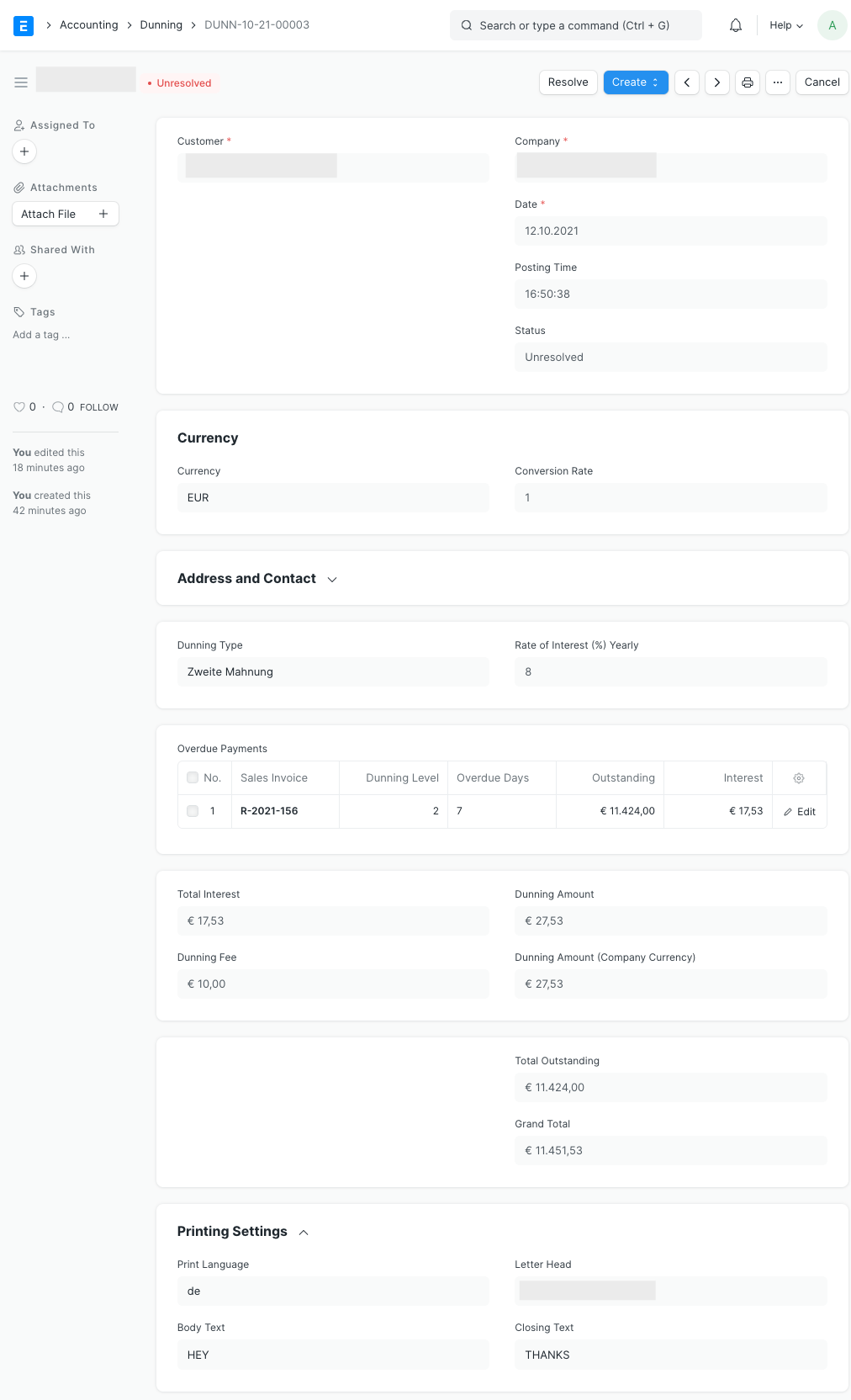

- Select a Dunning Type to fill interest, dunning fees and text blocks with predetermined values. Or you can set these values manually as well.

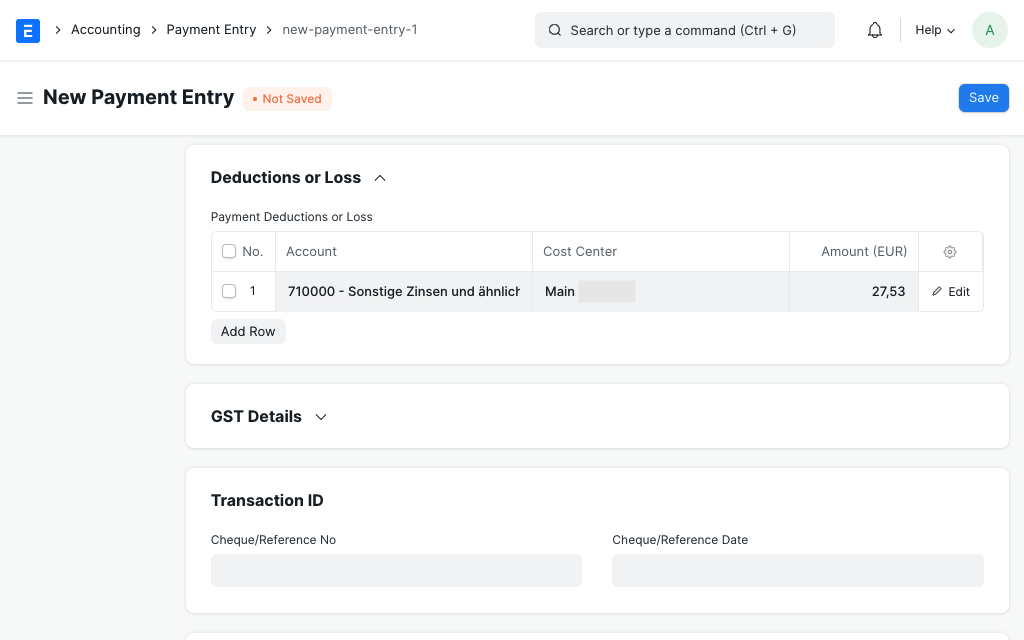

- You can already set an income Account (for example, "Other interest and similar income") and Cost Center for the income generated from interest and dunning fees. These will be used once a Payment Entry is created from this Dunning.

Save and submit the Dunning before sending it to the Customer.

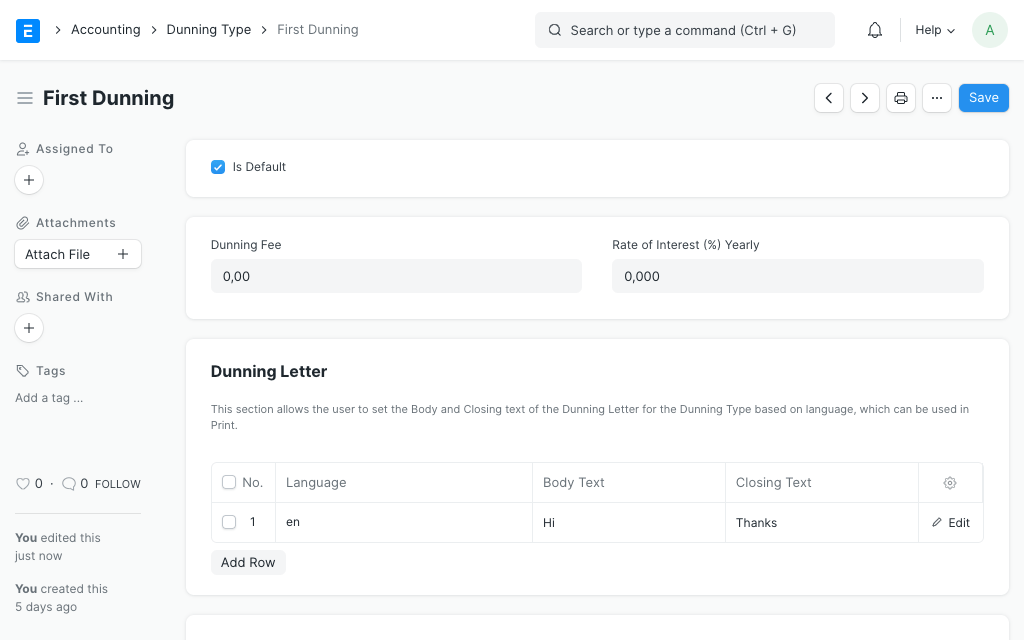

2.1 What is a Dunning Type

Dunning Type stores default values for dunning fee, interest rate and text blocks to be included. For example, a Dunning Type "First Notice" will not have any fees, but Dunning Type "Second Notice" will have a dunning fee and interest charged on the outstanding amount.

2.2 Statuses

These are the statuses that are auto-assigned to Dunning.

- Draft: A draft is saved but yet to be submitted.

- Unresolved: The Dunning is unresolved when it is submitted but no payments have been received.

- Resolved: The Dunning is resolved when the outstanding payment has been received.

- Cancelled: A cancelled status is a cancelled Dunning document.

3. Payment

When you receive a full payment, including interest and fees, please open the unresolved Dunning and click on "Create > Payment". This will create a Payment Entry against the outstanding scheduled payments and record the interest and fees as "Payment Deductions or Loss". The Payment Entry will automatically set the Dunning's status to resolved.